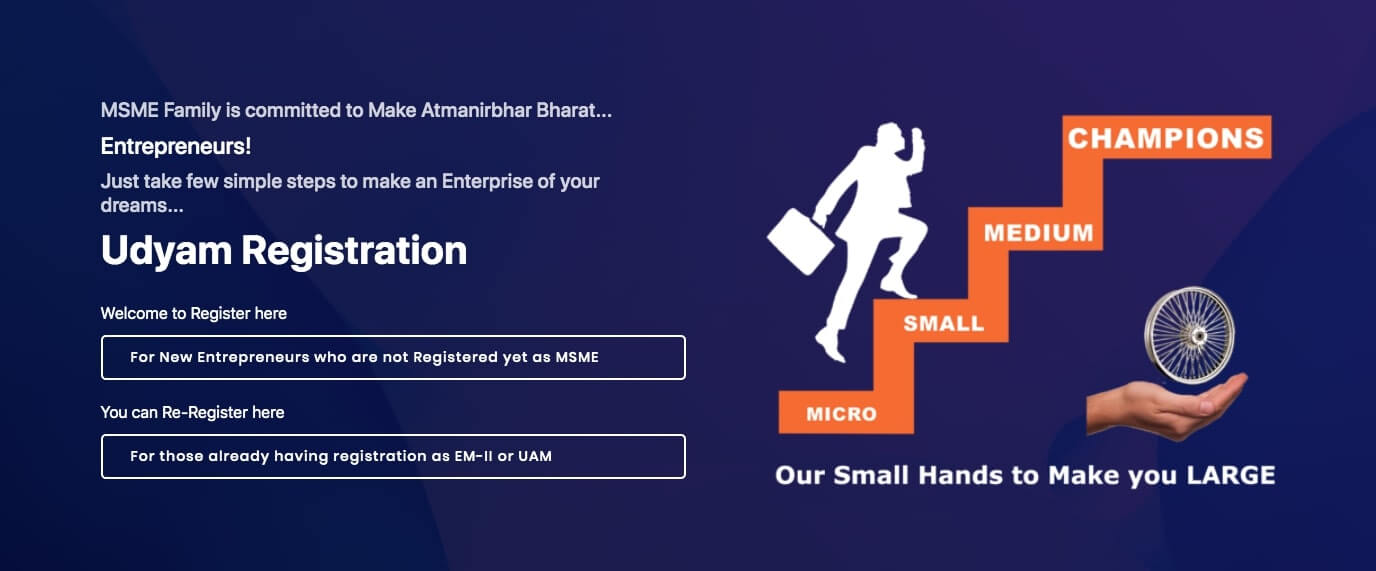

Indian Government launched many schemes during the COVID 19 regarding the business and changed the MSME Definition of the business. Recently Govt issued the new Udyam Registration Portal which is new initiative by MSME Department to register the new way for the MSME Registration or Udyog Aadhar Registration. Udyam Registration Portal hosted on the previous old website of udyog aadhar and also new website i.e ( Udyamregistration.gov.in)

What is Udyam Registration Portal (Udyamregistration.gov.in)

Udyam Registration Portal is designed for the small & medium business. When the government issued the notification regarding the new definition of the MSME , that time on the old Udyog Aadhar Portal there were a lot of the errors or issues like for ex retail or whole business are excluded from the NIC Code List etc. So each businessmane is confused how they can avail the government MSME Benefits without registering on MSME or Udyog Aadhar Portal. But Now after the Udyam Registration Portal Government Completed the change process & solved the all issues with the integration of other government platforms like GST Registration Portal, MSME Samadhan etc.

What is the Procedure for Udyam Registration Portal ?

So Before starting the Procedure on the Udyam Registration Portal or Website we have to know about the new definition of the MSME –

There are 3 Classification of any Enterprise under Udyam Registration –

#1 A Micro Enterprise is called when investment in machine or equipment can not exceed 1 Crore and turnover can’t exceed 5 crore.

#2 A Small Enterprise is called when investment in machine or equipment can not exceed 10 Crore and turnover does not exceed more than 50 Cr.

#3 A Medium enterprise is called when investment in machine or equipment doest not exceed more than 50 Crore and turnover not more than 250 Crore.

So How to Calculate the turnover or investment for the Udyam Registration –

For the Udyam Registration you have to calculate the turnover or investment simply through the Single GSTIN or Pan of the entity. It means if you have multiple GSTIN numbers for the firm or companies which are linked through only a single Pan Card of the Company then all these turnover or investment is calculated as 1 enterprise only for the Udyam Registration.

What are the Requirements for the Udyam Registration Portal –

The only requirements are that your firm or company fall under the new msme definition and intends to establish a micro small or medium enterprise as per the MSME Definition Act. Apart from the MSME Definition you also need the Aadhar Card which is main component for the Udyam Registration. So below are the simplified list so you can easily idenfitifed the aadhar card of the person as per the legal entity –

#1 In the Case of the Proprietorship Firm – AADHAR Card of the Proprietor is enough to register udyam registration

#2 In the Case of Partnership Firm – Aadhar Card of the anyone Partner is required.

#3 In Case of HUF – Aadhar Card of Karta is required

#4 In Case of Company/LLP/Trust – Aadhar Card of authorised signatory is required.

If in any case there is no aadhar card then there is Offline Procedure to apply directly at DIC (District Industries Center) with offline form by authorised signatory of the firm or company.

Who’s Required to Register Udyam Registration ?

So There are 2 type of the category of the Business which are required to Register under the Udyam Registration Portal –

Before 30.06.2020 –

#1 If your Business or Firm or Company is already registered before 30.06.2020 through Udyog Aadhar Portal and Get 12 Digit Udyog Aadhar Registration Number then you have to Again Register on Udyam Registration Portal till the 31st March 2021. Because after the 31st March 2021 your 12 Digital Udyog Aadhar Memorandum Number will be expired for the same.

After the 1st July 2020

#2 If your business is not registered on the udyog aadhar portal and having already other legal registration like GST or Pan etc or planning to start a new business in India then you can directly apply at Udyam Registration Portal instead of the old Udyog Aadhar Portal.

Udyam Registration Portal Step by Step Process with Video –

Udyam Registration Portal will be started from 1st July 2020 and following process or procedure will be involved in complete Online Registration Process –

#1 For Udyam Registration Aadhar Card number is required or mandatory.

#2 In case of the Private Limited Company or LLP or Partnership or Trust etc with the Aadhar Card , GST and Pan is mandatory to insert on the Udyam Registration Portal.

#3 There is no Government Official Fee for the Udyam Registration.

#4 Complete Udyam Registration will be done on a self declaration basis .

#5 No Company or firm cannot file more than 1 Udyam Registration Application and Generate Certificate.

#6 All the various business activity will be mentioned only into 1 Udyam Registration Application

#7 On the Completion of the Application, Portal issued a unique permanent identification number which is also called Udyam Registration Number

#8 The Udyam Registration Certificate will be issued as E- Certificate Copy with QR Code which is showing entity all the details

#9 Applications have to require or update the information on the portal regarding the previous year GST Return Filing or Income Tax Return details etc.

#10 After the 1st April 2021, Pan and GST both are mandatory for the Udyam Registration Portal.

What is the Penalty for Misrepresentation of the information on Udyam Portal –

If any business or person misrepresent the information on the Udyam Portal then there are 2 penalty as per the section 28 of the act –

#1 In the case of the first time conviction there is 1000/-INR Penalty.

#2 Second time it will be not less than 1000/-INR but may extend max 10000/-INR.

Complaint or Grievance Redressal on Udyam Portal –

Govt setup the champion portal to redress any problem related to udyam portal with the offices of MSME Department. They work as a single window system for the issue of the certificate to approve or complain.

How MyOnlineCA Helps on Udyam Registration ?

We at MyOnlineCA Providing Online Legal Services to small business and startups so if you are not familiar with the Udyam Registration then you can take our Professional Services where we can help to convert your Existing MSME or Udyog Aadhar to Udyam Registration or Apply New Udyam Registration with other compliance like GST or Pan etc.

FAQ Series on the Udyam Registration Portal ?

What is the Udyam Registration Portal ?

Udyam Registration Portal is designed for the entrepreneur who wants to avail the MSME Benefits and scheme by the Govt and convert previous Udyog Aadhaar for MSME Registration into the new Udyam Registration Process from 1st July 2020.

Previous MSME or Udyog Applicant have to Convert into Udyam Registration Portal

Yes, If they are registered before the 30th June 2020 then their UAM Validty is only till the 31st March 2021 and before that they have to convert their existing UAM to New Udyam Registration Number.

What are the main Documents Required for Udyam Registration

Only the Aadhar Card with the Pan is Required for individuals apart from GST for the firm or Company.

What is the Official Website for the Udyam Registration

Udyamregistration.gov.in is the official web portal for the Udyam Registration.

What are the benefits for the Udyam Registration

For the Benefits you can read the MSME Registration Benefits which you can avail also under Udyam Registration.