Today in this Guide we will discuss about CA Report for Student VISA or Visitor VISA who want to Visit Canada or Australia or any other Country. Recently in past year there is huge growth for Study in many countries from India but before providing the VISA to Student or Visitor every country Visa office want to check their networth or financial position through CA Report.

A CA report is a document through which you can justify your and your family’s net worth to the visa officer.

CA Report for Student VISA

This is a certificate which is published on the letter head of a practicing chartered accountant, where all your assets and liabilities are written and by subtracting both, your net worth is found out as to what is your personal net worth. And along with this, CA’s sign and seal is also put on this letter and whatever document we provide is verified and in this manner CA’s networth certificate is made.

Document required for issuing net worth certificate by a Chartered Accountant (CA) :

- Aadhar card and PAN CARD

- Valid passport

- Property ownership details

- Property valuation certificate

- Fixed deposit details

- Saving account details

- Gold and other valuable things

- Movable assets invoices

- Latest income tax return

And you will have to provide all the details that the chartered accountant requires to Prepare CA Report for Student.

CA report for Visitor Visa:

Generally there is no requirement of a CA certificate document in a visitor visa. But CA (Chartered Accountant) certificate is an important document required for visa application for different countries.CA Certificate for Visa is a statement issued by an eligible and practicing Chartered Accountant sustaining the financial position and background of the applicant.This document plays a vital role in the visa application process as it ensures the country’s embassy or consulate that the applicant has adequate financial resources to stay and travel within the country.

Why is a CA’s Networth certificate required?

Many times,whenever you apply for a visa at the embassy, the documents of your ITR for VISA or valuation of property are not sufficient here, so in such condition you have to attach the attested certificate of the CA’s net worth.Further processing starts from there.The CA certificate for Visa focuses on areas such as long term property, benefit calculation including money gold etc.It also mentions the person’s liabilities,to fulfill its purpose the CA certificate for Visa should reckon the total asset of the respective individual.

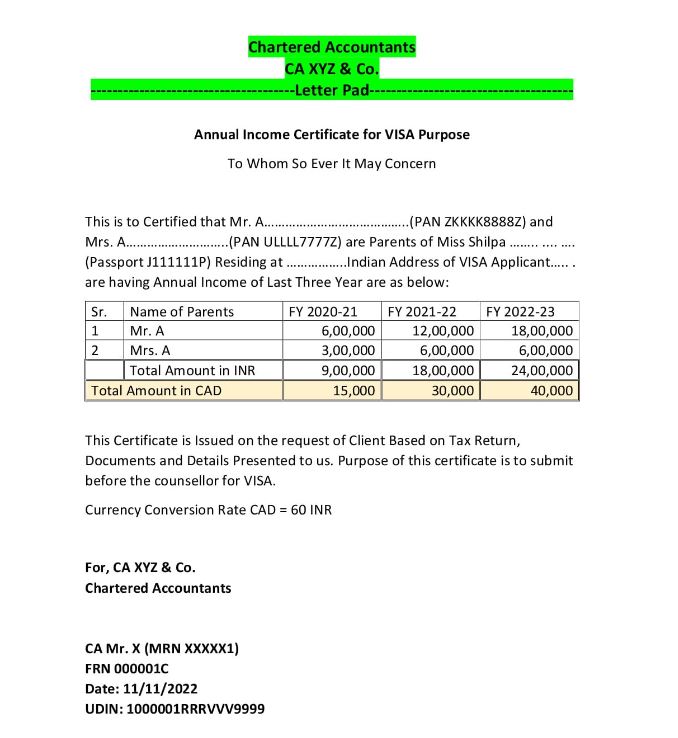

CA Report for Canada Student Visa Sample

While I can provide some general information, it’s important to note that specific requirements may change. Typically, for a Canadian student visa, a Chartered Accountant’s report may include:

Proof of Funds: This could involve bank statements, income statements, or other financial documents.

Income Source: Information about the source of income, whether it’s personal income, family support, or any other means contributing to the student’s finances.

Letter of Explanation: A letter from the Chartered Accountant explaining the financial situation, verifying the authenticity of the provided documents, and confirming that the student has sufficient funds to cover the costs.

Professional Certification: The report should be signed and stamped by the Chartered Accountant, indicating their professional credentials and verifying the accuracy of the information provided.

Additionally, consulting with a Canadian immigration expert or the designated authority can provide more accurate and up-to-date information.

ca report for canada student visa sample

Is a CA report mandatory for a Canadian student visa?

Should we attach this report with our file or not? This is a big debatable question and most of the agents say that there is no requirement of a CA report and to some extent it is also true.

- For SDS category (Student Direct Stream) CA’s report is optional.

- For the NON-SDS category,CA’s report is considered as a mandatory document.

- And for Reapplication category people it is important that you should attach this document with your file.

CA Report for Australia Student Visa –

Whatever type of visa you apply for, be it an education visa or a tourist visa, all types of visas require financial documents to prove that the person is well settled.

Documents Required for CA Report for VISA ?

- Funds – Whether the funds are in savings account or fixed deposit account, only those accounts which are in nationalized banking and are eligible to be verified online will be valid.

- Income – It is necessary to have the income of all the people you are showing in the document and whether the income is private income or government income, you are submitting ITR or not , Form 16, all this is checked.

- Pay slips – Payslips are also needed to justify your experience.

- Property valuation – Property valuation is done by architects and such reports can enhance your profile,create confidence in it.

- Affidavit of sponsorship – If someone has sponsored you then an affidavit of sponsorship is made,that affidavit has to be attached.

How to use CA certificate in VISA Application:

Usually there is no requirement of a CA certificate in a visa. Attaching a CA certificate can sometimes deteriorate your case, it shows desperation and when the person attaches unnecessary documents, going beyond the checklist, the Consulate refuses to accept your documents in BFS itself.

A CA certificate can be attached in cases where your source of income is versatile.That means the person does not have a fixed salary. The person is receiving returns from different places.In such cases, a person can consolidate his total income by submitting a net worth certificate.

CA Certificate for VISA Fees

Its totally depend on the experience & location of the CA. If we talk about the Market Price then Its Cost approx 2k to 5k for the same. you can Contact to myonlineca for the lowest cost & Best Service Quality in India.

Conclusion

It’s very crucial to check specific requirements outlined by the Canadian immigration authorities or the educational institution the student is applying to,as these can vary.