Tax on Sale of Property in the Year 2016

In India Real state are hot topic in India and As Investment sale of property arise the capital gains so Today we talk about the Ultimate Guide on ” Tax on Sale of Property in Year 2016″. Recently did you sell your own house or Land or any capital gain assets then its arise the Capital Gain taxes which you have to pay to the government.

So First of all before calculate the Capital Gain taxes you should have to checkout that its a long term capital assets or else short term capital assets.

So Thera are 2 Type of Capital gain taxes :-

a) Short Term Capital Gain Taxes :- if the Assets is Held for the 36 Months

b) Long Term Capital Gain Taxes :- if the Assets is Held for the more than 36 Months

What is the Rate of Capital Gain Taxes ?

Capital Gain Taxes rate are following all the Assets except the Shares and Mutual Funds :-

Short Term Capital Gain Taxes :- Its is calculated As per Normal Income tax Slab Rates

Long Term Capital Gain Taxes :- Its has a Flat Rate that is 20%

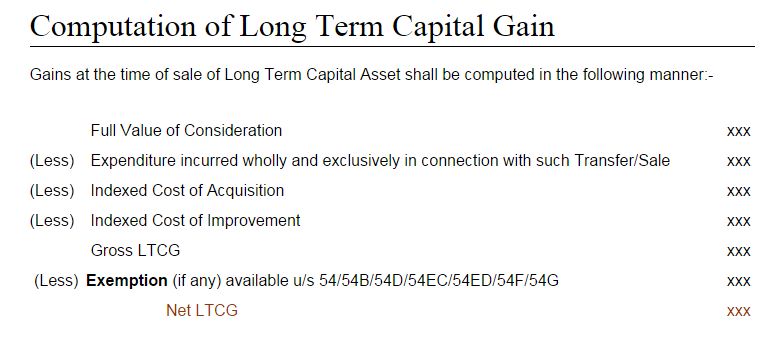

Calculation of the Capital Gain Taxes :-

How to Save Taxes on Sale of Property in the year 2016

| Section | Capital gain | On sale of | New property to claim exemption |

| 54 | Long term | Residential house property | House property |

| 54EC | Long term | Any asset | NHAI or REC bonds |

| 54F | Long term | Asset other than residential house | House property |

| 54B | Long term or short term | Agricultural land | Agricultural land |

| 54D | Long term or short term | Compulsory acquisition of land or building used for industrial undertaking | Land or building for the purpose of industrial undertaking |

| 54G | Long term or short term | Capital asset used in industrial undertaking in urban area | Capital asset for use in industrial undertaking in non urban area |

| 54GA | Long term or short term | Capital asset used in industrial undertaking in urban area | Capital asset for use in industrial undertaking in SEZ area |

| 54GB | Long term | Long term capital asset | Equity shares in eligible company |

Hope this article helps you, For the queries you can ask from the legal experts below regarding any issue.

[jotform id=”53634484507460″]

Source :- CharteredClub and TaxMasala