Today in this Guide we will Learn about Response to Confirm/Revise Claim of Refund Meaning. As we all know that due date for Income tax return filing is over for people other than those covered under audit, Income tax department is sending e-mail and messages to people who have claimed refund, to confirm/ revise their refund claim on e-filing portal, hence as to confirm that refund claimed by them is genuine and they have not filed any revise return after that return in which refund amount has been changed.

Response to Confirm Revise Claim of Refund Meaning

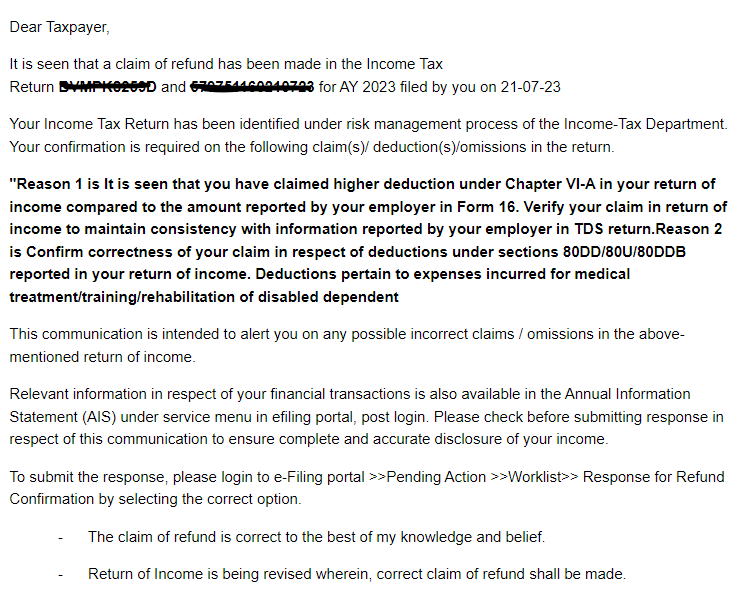

Below are the Email Context which is sent by Income Tax Department regarding the Response to Confirm Revise Claim of Refund.

The E-mail from IT department to taxpayer received is as under:

“Dear Taxpayer,

Your income-tax return has been identified under risk management process of the Income-Tax Dept. In this context, your confirmation is required on the following claim(s)/deduction(s)/omissions in the return.

How to Response to confirm/revise claim of refund

Risk Management Process is usually followed by most of the salaried person to claim excessive deduction even though it is not reflecting in Form 16 which is issued by employer, and they have not made the investments specified under Income Tax Act 1961- chapter VI-A.

Some time it happens that an individual has genuinely made the investment, but it is not reflecting in form 16 issued by their employer as investment proof is submitted to employer or sometimes after submission to not considered by their employer. If the employee has invested the money, then no need to worry even though it is not reflecting in form 16 and notice is received by the taxpayer. Taxpayer has to response to confirm/revise claim of refund for ay in given time limit.

When Income Tax Notices Come ?

Notices is being sent to taxpayer by department who has:

- Claimed the deductions U/s 80G for the first time.

- Excessive deductions claimed which are not reflecting in form 16.

- Businessman whose gross total income decreased.

- Various investments are shown for claiming exemption under chapter VI-A.

- Home loan interest is shown to reduce the tax.

- Claim the refund of TDS deducted.

Time To Respond While issuing the notice department is giving the opportunity to verify the correctness of the claim made in the return of income filed and submit the response within time period of 30 days of the receipt of the email. The taxpayer can response to confirm revise claim of refund either claim made in return of Income is correct or he /she will revise the return of income to correct the amount of Refund claimed.

How to submit response to this ?

To submit your response to confirm/revise claim of refund, please login to e-Filing portal, click on Pending Action, click and select Worklist, click on ‘Response for Refund Confirmation’ and select the correct option.

– The claim of refund is correct to the best of my knowledge and belief of income are correct.

– Return of income is being revised wherein, correct claim of refund shall be made.

Before responding any option, we advised you to take advice from MyOnlineCA. Please verify the correctness of claims made in your return of income filed and submit your response within 30 days of receipt of this e-mail. In case you are failed to respond the e-mail then not your ITR nor your claim has been filled and verified.