333Today in this Guide we discuss about Income Tax Refund Not Received Yet then what are the reasons or what are the action which is required to reissue the Income Tax Refund. You will learn about Meaning of Income Tax Refund Not Processed or Income tax return Processing Completed but Refund not Received.

Reason for the Income Tax Refund not Received

Following are the Reason when Income Tax Refund not Received –

- Your Income Tax Return [ITR] Intimation letter or Processing is not completed Yet.

- Your Income Tax Return Intimation letter or Processing is Completed But You Got the Outstanding Demand

- Your ITR Processing is Completed and Refund Order has been issued but Your BANK Validation has been Failed.

Process of the Income Tax Refund

Once the Income Tax Return Filing has been Done, the income tax department starts processing the income tax return. After that tax return is processed, it generally takes an average of 4-5 weeks for the tax refund to be credited to the taxpayer’s bank account. Further, it has also been noted that in some cases, tax refunds are processed within 7-8 days of filing the income tax return.

It is important to note that Income Tax Refund is issued to you only after the Income Tax Department processes the ITR. As per income tax Act, 1961 under Section 143(1) a notice is sent to you on your registered E-mail id as well as on your e-filing account on the Income Tax Portal.And that notice signifies to the individual whether their tax computation matches with the tax department.

What is 143(1) ITR Intimation Letter for Income Tax Refund

ITR Intimation letter Simply provide comparison between the Filed ITR and Computed by Income tax system or Officer. so There are 3 kind of the cases happen when 143(1) has been issued.

- If the taxpayer has paid tax more than the said amount then the tax refund is also mentioned in it. Refunds are initiated only when the amount exceeds Rs 100.

- If the tax paid by the taxpayer is less than the said amount, it also mentions the amount and challan to be paid.

- If the ITR filed by the taxpayer is consistent with the assessment of the assessing officer, a simple acknowledgment is given.

Meaning of ITR Not Processed

Generally ITR-1 and ITR-4 has been processed quickly but if we talk about ITR-2 or ITR-3 which takes more time nearby 6-7 Weeks. So if your ITR is not Goes under Processing i.e you will get Not Refund or Intimation Letter 143(1) regarding the Refund.

Meaning of itr processing completed but refund not received

If your ITR processing is completed but you haven’t received the refund, a common reason for not getting a refund immediately is that incorrect or incomplete information has been given in the ITR form. If any past tax demand is still unpaid, the Assessing Officer has the power to regulate the refund payable to the assessee against the past due after proper notice. And at the same time you should check the status on the official income tax website or contact the tax authorities for assistance.

What to Do if Income Tax Refund Not Received Yet

You can take following Actions –

- Check your Bank Account is Validated or Not

- Check your ITR Processing is Completed or Not

- Check your ITR Intimation Letter Status i.e Refund Order has been issued Or Not.

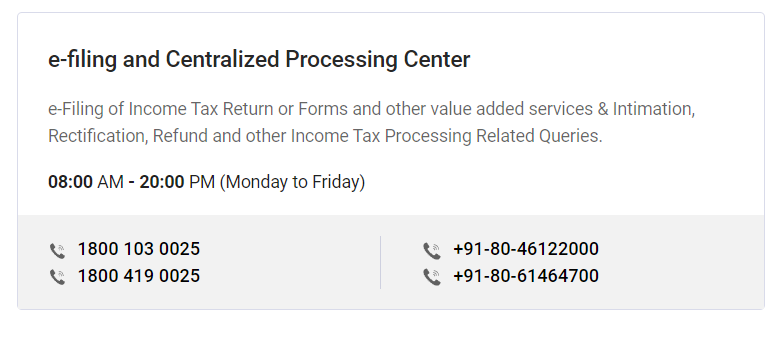

Still if not got the Refund then Income Tax Portal Provide the Grievance Mechanism where you can raise your Complain by Login into the Income tax portal or you can contact on 1800 103 0025 Number. Below are the Contact Details of Income Tax Department for Refund realted issues.

So Hope now your all issue has been Resolved realted to Income Tax Refund. Still if you have any Query then you can Book MyOnlineCA Consultancy.