The Third and most important form of GST Return filing is GSTR-3B. This form is filled with GSTR-1 and GSTR-2. You have to deposit more tax or refund or return according to all the sale of goods and all the purchases in the month, it shows GSTR-3B. In this post, we will learn how to fill the form GSTR-3B. Find out what are the details to fill in Form GST-3? What are the things to keep in mind to fill them? So let’s start GSTR-3B with an introduction .

What is GSTR-3B

In your first return form GST-1, you had completed the details of all the sales and gave details of the GST deposited on them. Likewise, in the second return form, GSTR-2 had given details of all the purchases and the repaid GST on them. Now the third return form i.e. GSTR-3B will be a summary of both of these return forms. At the same time, after all the accounts, how much tax is being created on you, it will also be mentioned. You pay GSTR-3B after repaying your tax liability. One more thing, GSTR-3B, like GSTR-2, gets a lot already loaded, filling the remaining part and paying taxes is your job.

Who needs to file Form GSTR-3B

In GST system, it is compulsory for all registered businessmen to enter GSTR-3B except for traders who register themselves in the composition scheme and some other specialized category businessmen. Actually, whoever has GSTR-1 and GSTR-2, they have to fill GSTR-3B too.

Who need not file GSTR-3B

- Registered business under composition scheme

- E-Commerce Operators

- Input Service Distributors

- Foreigners (non-resident dealers)

- Tax deductors

- Government Department or United Nations Office with Unique Identification Number (UIN).

The last date for submission of GSTR -3

Generally, GSTR-3B has to be submitted after the business month by 20th of the following month. The last dates for filling GSTR-2 and GSTR-3B vary from 5 days.

According to the notification issued by the government on 5th September 2017-

The GSTR-3B form of July 2017 can be submitted by filling up to 30 September.

A GSTR-3B form of August 2017 can be filled up by 15th October.

Process for filling GSTR-3B form

GSTR-3B like last return forms GSTR-1 and GSTR-2 will also be filled in just 5 steps. When you fill in the GST-3 return form in the fourth step, then you have to fill some details separately. We have explained them in the next headline.

Step 1

Go to web address www.gst.gov.in This will take you to the GST portal’s homepage.

Step 2

Login with the help of your username and password. Your dashboard will appear before you.

Step 3

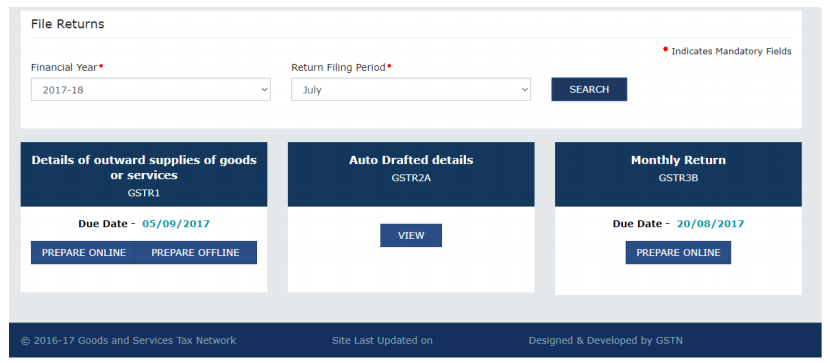

You will see the GST Return Page once you click on the “Service Menu” in the blue bar above.

Step 4

On the GST Return Page, you will see a window of all returns. Select your return i.e. GSTR-3. The complete form will be divided into 15 parts. Fill it up and collect it.

Step 5

At the bottom of the form, you have to sign your signature. Companies are required to make a digital signature. The rest have the option of both Digital Signature or E-sign.

Details To be filled in GSTR-3B

I will tell you about the Details That are to be filled in GSTR-3B Form, which is as follows:

GSTIN:

This is a 15 digit number based on your PAN number. Since you log in your account from this number, it will automatically get your form filled in GSTR-3B.

Name of the Registered person and Trade :

This section is divided into two small columns. Due to login to the account, both of this information is also automatically filled in Form GSTR-3B.

a Name of Taxpayer:

Business Name

Month and Year:

In addition to filling the name, fill the GSTR-3B returns related to the month and year, fill in the column in the nearby column.

Annual Turnover:

In this section, your turnover will be filled in detail of all the sales made during the year. This whole section is divided into 7 parts.

(i) Taxable Turnover other than zero-rated

In this, the total sales of all those sales will be recorded, which is the GST. Whether it has been sold to registered buyers or unregistered buyers

(ii) Zero-rated on the payment of tax

It contains all the export (export) on which the buyer has to deposit IGST. In return, a refund can also be made instead.

(iii) Zero-rated supply without tax

This includes exports that are not sent by IGST, but the goods are sent by paying the bond or by giving the LUT (letter of undertaking).

(iv) Deemed exports

There are items that are sold in Special Economic Zone (SEZ).

Deemed exports: Projects involving an international partnership. Although the goods sent to them remain in the country, but it has been kept equivalent to the export. There is also a rule to repay IGST on these related purchases. This rule will apply even when the goods are sent to the Special Economic Zone (SEZ).

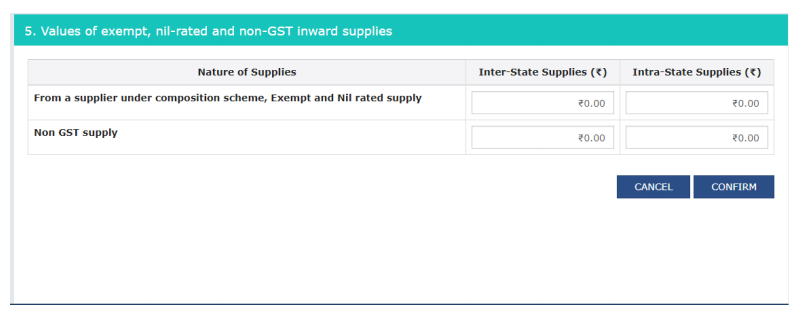

(v) Exempted Supply

Total sales of goods or services, which do not seem to be GST.

(vi) Nil Rated Supply

Goods or services that the government has kept within 0% GST, their total sales

(vii) Non-GST supply

It records the total sales of those items which are not within the purview of GST. Such as petrol, electricity and so on

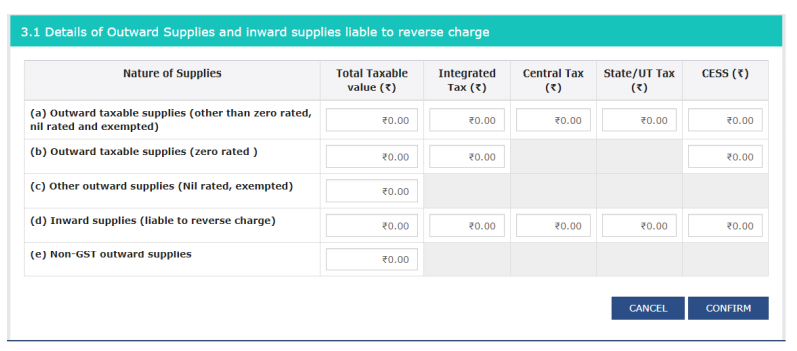

Outward supplies:

This section records the total sales for your entire month. Due to your GSTR-1 being filled, its all details are filled automatically.

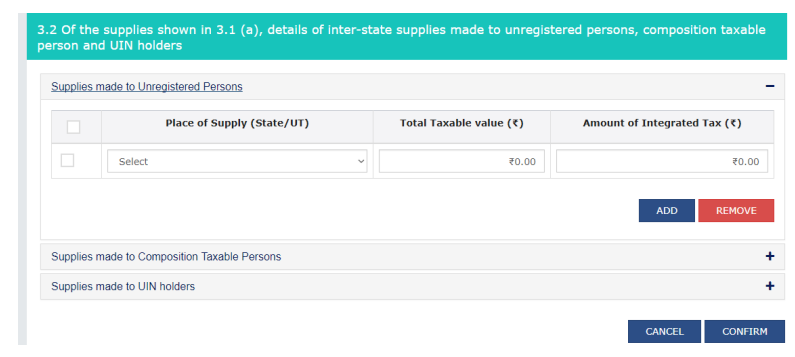

4.1 Inter-State supply (Net Supply for the month)

It mentions sales of your entire interstate (among the business of two different states) sales.

A.Taxable supplies (other than reverse charge and zero-rated supply)

It would mention all of your sales on whom GST looks. However, they do not include a reverse charge or zero-rated sales.

Supplies attracting reverse charge-tax

Sales on which the buyer has to pay GST directly to the government directly under the reverse charge.

Zero-rated supplied with payment of IGST

These are such exports which the buyer has to pay IGST on sale. (They can claim for a refund later)

D.The value of supplies made an e-commerce operator attracting TCS

Such sales happen through e-commerce operator and those on which TCS has been cut. They will be mentioned separately here. It will also show GSTIN of e-commerce operator

4.2 Intra-state supply (Net supply for the month)

This will also be filled in accordance with column 4.1. The only difference would be that in 4.1 there were sales related to interstate, now 4.2 will only be registered in the state of Intra State.

4.3 Tax effect of amendments made in outward supplies

If there is a change in your sales invoice, then it is mentioned here. Note: Tax liability will also be affected if there is a change in the amount of a deal. It can be even higher than before and can even decrease.

Inward supplies attracting a reverse charge:

This column mentions all your purchases during the respective month. Due to GSTR-2, deposited on your behalf it will be mentioned in all your purchases.

5A Inward supply on which tax is reverse charged

There are details of your purchases in this, where the reverse charge seems to be GST. (In the reverse charge, the buyer has to pay a GST on that deal to the government.) It will get you GST registered in the state (intra-state) and for the inter-state outside the state.

5B Tax effect of improving

In this, there are cases of reverse charge GST, which have been modified in the amount after which any change has been made later. Clearly, this will affect your Input Tax Credit – ITC and tax liability.

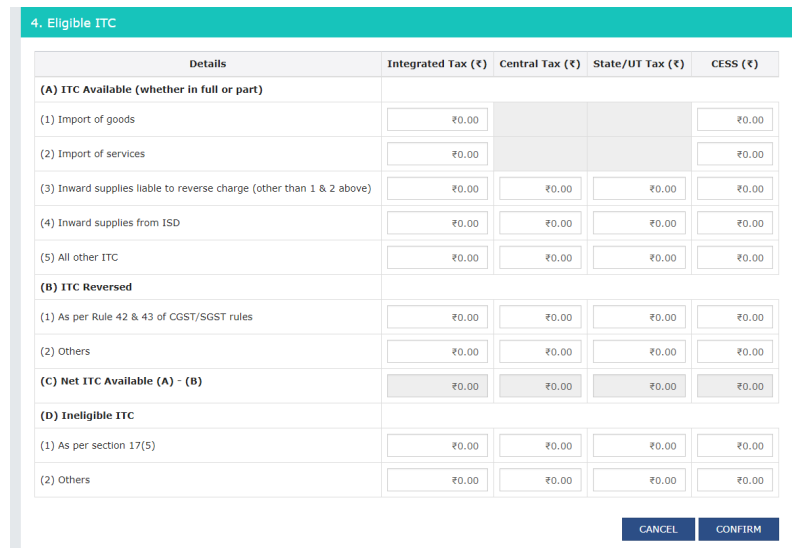

Input Tax Credit:

In this section, your table contains details of Input Tax Credit (ITC), which is found on GST of all your purchases. These also include ITC from imported ITC and Import Service Distributors (ISDs).

It has two parts-

Part I

In this, you get the summary of every kind of ITC. As such, ITC, on the purchase of inputs on raw materials, Capital Goods like ITC on the purchase of computers etc., and ITC etc. sent by Input Service Distributor (ISD).

Part II

In this, only those cases related to the ITC related to the previous purchases of your Tax Month are mentioned in which there has been a change in the way.

Addition and reduction in output tax for mismatch and other reasons

Addition and reduction in output tax for mismatch and other reasons

It mentions deals that do not match in Input Tax Credit (ITC) and tax liability (mismatches). This information is recorded on your behalf in the system from GSTR-2.

In this section, you have to give 7 types of information related to ITC.an ITC claims on mismatched or duplication of invoices or debit notesMistakes in receipts or cases of incorrect ITC claim due to duplication in receipts. Or there is a case of debit notes due to any change in the deal, everyone is mentioned here.

- Tax liability on mismatched credit notes

If your wrong credit notes have been issued on your behalf, your ITC will also change. The Extra ITC you got because of this has been added to this time tax liability. Such deals will be mentioned here.

- Reclaim on rectification of mismatched invoices/debit notes

Due to the receipt of the receipts, or because of the wrong Debit Notes issued to you, those deals were found here. You reduce your existing tax liability for less ITC.

- Negative tax liability from previous tax periods

If you have ever deposited more tax in the previous month, then it will be mentioned here. This will reduce the tax liability of your current month.

- Tax paid on an advance in earlier tax periods

In the previous month, the tax collected with advance payments will be mentioned here, it is shown received in this month.

- Input Tax credit reversal / reclaim:

In this case, cases of ITC being reversed or reclaimed are mentioned for any other reason.

Total tax liability

This is the real part of Form GSTR-3B. It will be mentioned in the tax liabilities created on you. You will see different amounts of CGST, SGST & IGST The system of GST Portal automatically calculates your tax liability here.

This section is also divided into four parts

8A On outward supplies

GST is being created on all your inter-state sales

8B.On inward supply under reverse charge

Total GST due to reverse charge on your purchases

8C On account of ITC reversal or reclaim

Due to ITC reversal or reclaim, there is a mention of the reduction in tax liability on your tax liability. This information is registered here on the basis of Table 11 of GSTR-2.

8D On account of mismatch/rectification / other reasons

If there is a difference in your tax liability for any other reason other than the above-mentioned reasons, then it will be mentioned here.

The credit of TDS and TCS

Wherever TDS or TCS is cut off on purchases made on your behalf, it will be mentioned here. These are subtracted from your total tax liabilities. The rest you have to pay.

Interest liability

You will have to mention the interest that you have to repay in late GST Payments on your behalf. In this column, you will mention the amount of interest applied to you and its causes. There will be separate mention of CGST, SGST, IGST & Cess etc.

Late Fee:

You have to pay a late fee of Rs 100 per day on a delay of any return. In this column, it will be mentioned. It can be up to a maximum of Rs 5000.Up to 11 parts get filled in your account on the GST Portal. Now you have to fill the bottom four parts yourself.

Tax payable and paid:

After deducting total Input Tax Credit (ITC) from the tax liability you are earning, the amount that comes out is to enter and pay here. You enter CGTS, SGST, IGST and Cess in four forms of Payments in the detail form in the columns given to them. Then they enter their total too.

Interest, Late Fee and any other amount payable and paid:

In it you have to register the Amount which you have to pay as interest or Late Fee. In this also you have to mention different interest and Late Fee in front of CGST, SGST, and IGST

Refund claimed from Electronic cash ledger

If you have deposited more GST than your tax liability then you can claim a refund for it. The extra deposit amount will be returned to you if your claim is correct.

The Refund Claim, which you do through Table 14, is recorded as a debit entry in your electronic cash accounter. But the valid claim will be valid only after the valid GSTR 3 is deposited.

Debit entries in electronic cash/Credit ledger/interest payment

When you deposit your taxes and all your returns are deposited, this section will automatically fill in your returns.

Conclusion

In the end, I would like to say that when you are filling this form you must make sure not to make any mistakes as it might delay the process of filling GSTR-3B form.