In this Article At Myonlineca, We will discuss How to file income tax return online for salaried employee and Who is required to file income tax returns? Which form should you choose for income tax return filing for salaried employees? And What is The Procedure to online income tax return filing for salaried employees ?

The due date to document your Income Tax returns for the Financial year,2017-18 is 31st July 2018. In the event that your pay is amid these years has been more than the pay charge piece or Income tax slab, you have to record your Income tax return. Normally one goes to an expert to record the profits, yet in the event that you don’t have numerous ventures, you can document your Income Tax Returns in simple advances online in the solace of your home, for nothing. This internet recording is otherwise called e-filling.

Who is required to file income tax returns?

- In the event that your pay for the money related year 2016-17 has been more Rs 2.5 lakhs in India barring the conclusions from Section 80C and 80U, you need to record pay assessment forms or Income Tax return (ITR).

- Regardless of whether you are an NRI, your salary in India should be petitioned for ITR. In the event that you are more than 60 years of age however under 80 years, you will be you required to document ITR if your salary for 2016-17 is over Rs 3 lakhs before reasonings.

- In the event that you are more than 80 years old, at that point, you need to record ITR if your pay is over Rs 5 lakhs before findings. In the event that you need a pay to impose discount or need to convey forward your misfortunes under any head of income (like misfortune from the offer of value shares).

- In the event that you have had any long haul capital increases amid the monetary year, you have to record assess regardless of whether your salary is tax-exempt.

- On the off chance that you are wanting to apply for an advance or visa, you might be requested verification of Income-tax Filling.

Which form should you choose for income tax return filing for salaried employees?

Income Tax office has different structures of Itr Form relying upon the citizen’s necessities. Since this article is centered around a salaried person just, your form will be ITR 1 for filling itr for salaried person. Presently, there are two different ways to record this Form, by downloading it or documenting it on the web. The most ideal approach to record your profits online downloads the pre-filled excel sheet as opposed to documenting it online on the grounds that one can’t foresee power cuts and web association interruptions.

How To File Income Tax Return Online For Salaried Employee

Before I tell you How to file income tax return for a salaried employee, I would like to tell you that in oreder to perform income tax return filing for salaried employees through online mode, first you need to register with the Income Tax Website then you can file Itr for salaried person. If you are already registered you can skip this part.

How to Register yourself on Income Tax Website for income tax return filing for salaried employees

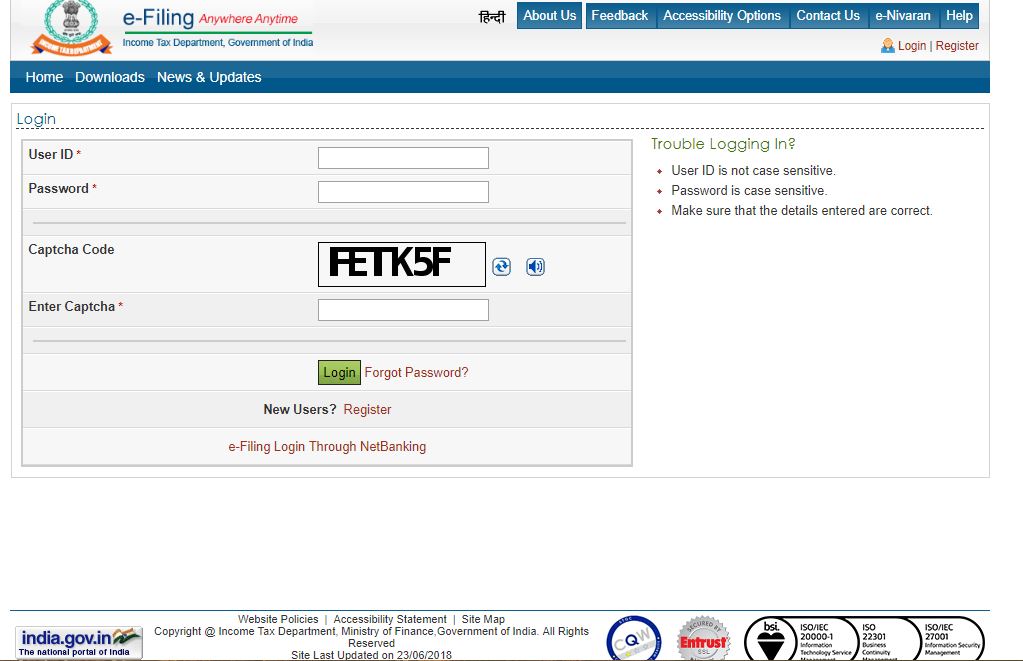

- To register on income tax website first you have to go to this Link – https://portal.incometaxindiaefiling.gov.in/e-Filing/UserLogin/LoginHome.html?nextPage=efileItr1&lang=eng And click on Register to register yourself.

- When you tap on Register Button you will be diverted to a form to choose your status, you need to choose individual and tap on submit and In next screen, you will see the alternatives to enter your PAN, DOB, Resident status, Mobile, Phone and so forth fill all details and submit.

- Next, you will be requested to fill in your contact details and Please take note of that mobile number and email ought to be available as OTP will be sent for confirmation.

How to file income tax return for salaried employee online

- Now that You are registered or is already registered, You have to Login into Income Tax website with user id and Password.

- Once you have logged in to your account, You will see the dashboard. Now To file your return, you have to click on e-File menu on top header bar then a drop-down list will be visible, click on Income Tax Return.

- After that, you have to Select the Assessment year 2018-19 in assessment year option and Select form ITR-1 in Itr Form name option.submission mode should be prepare and submit online. You can select Aadhaar based OTP for e-verification. You receive OTP on your mobile which will be valid for next 30 minutes and Once these details are filled click on Submit button.

- The following screen will open with ITR-1 form and ITR-1 form will have following tabs such as Instructions, Part A General Information, Income Details, Tax Details, Taxes Paid AND Verification and Section – 80G. In Instruction and section A, you need to fill general Details, for example, name, PAN number, and address.

- To fill compensation subtle elements tap on Income Details tab of ITR-1 form and In this tab, first choice B1. Income from Salary/Pension is the correct cell for you. You to fill your wage from pay here. Note, fill net assessable pay according to Form 16. Numerous commit error of filling net assessable compensation which is in the wake of deducting 80C investments. You need to fill pay before guaranteeing Chapter VI conclusions.

- Next thing you need to do is to fill charge subtle elements. Tap on Tax Details tab. Here subtle elements will be auto-filled, however, ensure that TDS sum is coordinating with Form 16 given by your employer. Companies deduct charges from pay and pay it to government and record their TDS returns. In light of TDS return, assess credit is given to deductee. If your TDS Details were recorded wrong you won’t get the credit here. You have to chat with your organization to remedy the TDS details. In case these are not auto-filled, that implies your organization committed an error in recording TDS return. On the off chance that you fill subtle elements physically and continue at that point return will be handled with request information.After this tab next you need to tap on Taxes Paid and Verification Tab.

- Here you will discover rundown of your duty obligation and duties you have paid. Make beyond any doubt that sum payable is 0. Generally return won’t be recorded.

- Next, you need to give your bank subtle elements in the same tab. Here you need to give Details for all your bank account. In check, part fills the name of your Father and Place. Once the form is filled totally, you can continue with Preview and Submit button. Once tapped on see and submit catch, finish form with filled Details will be made accessible. On the off chance that everything is flawless you can present your arrival.

- When you have submitted or documented your arrival you need to confirm your arrival inside 120 days generally return won’t be processed. You can check you come back with following choices, for example, Sign with EVC (bank based OTP), Sign with Aadhaar based OTP and Sign and send the printed copy of affirmation to CPC Bangalore.T he best technique is to sign with Aadhaar OTP. Once you confirm your OTP. The procedure for filing income tax return filing for salaried employees is finished.

Conclusion

I Hope you like this article about How To File Income Tax Return Online For Salaried Employee. still, if you are confused you can check out our website to know more about how to file income tax return for a salaried employee.