Today in this Guide we will discuss about How to Download Income Tax Return Computation. After Filing the ITR when you submit for any official purpose like Bank Loan or Credit Card etc they always ask for ITR Computation. So in In this post, we will explain the complete step-by-step process to download your computation of income tax return. We can also provide you with a download link to generate your Income tax Computation so make sure that you read this helpful article till the end.

What is Income Tax Return Computation

In most cases your income tax computation is required when you apply for a credit card, loan, etc. If we talk about Income tax computation then you can’t download or generate it from the official website of the income tax department, you can only download your ‘Income tax acknowledgement’ and ‘income tax form’ from the official website of the income tax department.

But don’t worry we have a solution for you to generate your Income tax computation, you just have to follow some simple and easy steps to generate your ITR computation. Just click on the ‘Download’ button and download the excel sheet which is given below and also you have to follow some easy steps to generate your ITR computation.

Download ITR Computation Format –

Download ITR Computation Format Here

I hope that you downloaded the ‘ITR Computation Format’ using our link. After downloading the Format you have to fill in some information related to your income tax return.

Process to Fill The ITR Computation Format –

The only thing that is required to fill the Income tax return format is your ITR form. If you don’t have your ITR form then download it from the official website of the income tax department after the ITR Filing. After downloading the ITR form you’ll have to follow the given steps.

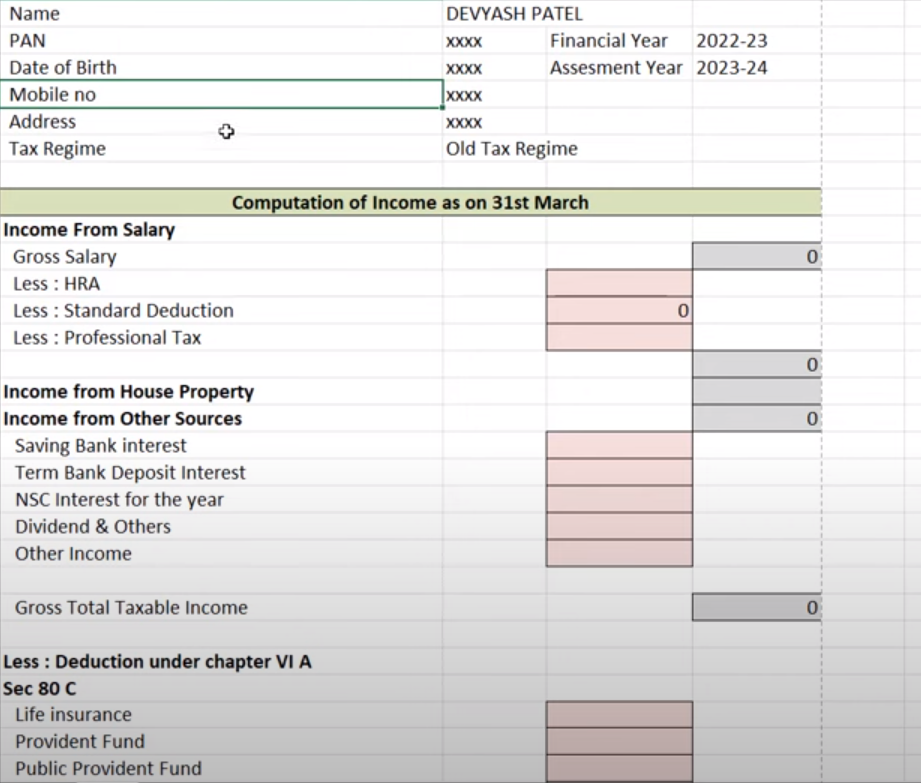

- In the first step you have to fill in your name, DOB, mobile number, address, tax regime (old/new), financial year and the assessment year.

- After the first step fill your gross salary which is given in your ITR form just copy and paste it.

- If you claim your HRA then fill your HRA from ITR form which is given in “section-10” in the ITR form you can also fill your other types of deductions in given columns.

- Fill your savings bank account intrest, FD interest and dividend.

- If you contribute in life insurance, pf, ppf, investments, housing loan, etc then fill your all information as they are given in the ITR form.

- After that fill your savings bank deduction which is given in the ‘80TTA’ column in your ITR form.

- If you have any pension plan then fill your information which is given in the sec-‘80CCC’.

- If you have any health insurance deductions then fill your information which is given in the sec-’80D’.

- Now fill your ‘Total Taxable Income’ in the given column.

- After that fill your tax in the ‘Tax Payable column.

- Now fill your tax rebate as per sec-87A.

- If you have any TDS (salary/from bank) deduction then fill it according to the ITR form.

- In the last step fill the Tax payable/refundable.

By following all these simple and easy steps your Income Tax Return computation format is completed now save it in your computer system. If you have any doubt related to the ITR Computation then you can Contact to MyOnlineCA anytime.