What is Udyog Aadhaar Registration

Today MSME (Micro, Small and Medium Scale Industries) is playing one the major important role in India’s growth. So indian govt always prepare the government scheme & loans and incentive for this msme sector. To avail these scheme govt required the proper registration of the business with th MSME Department so from the oct 2015 on the recommendation of kammath committee govt launched the Udyog Aadhaar Registration which simplified the legal registration & issued a 12 digital unique Udyog Aadhaar Memorandum Number so each business can be track easily by the ministry of micro, small and medium enterprise.

Note – From 1st July 2020 Udyog Aadhar Convert into Udyam Registration with same benefits.

Why MyOnlineCA for Udyog Aadhaar Registration ?

Govt of India platform i.e (udyogaadhaar.gov.in) is very difficult for the udyog aadhaar registration because they have lot of the option in the udyog aadhar application where required the expert advice from the choose the Right Kind of Business Structure or Legal Entity to Business NIC Code. so we build a very simplified platform with Expert Advice to get done your udyog aadhaar registration where you got below some unique features –

1. Right Legal Entity – Our Legal Experts of platform helps you to choose the right legal entity by the experts. lot of the entrepreneurs are starting the new business so they are confused to choose the right legal entity in the starting.

2. Aadhaar Card linking with Registered Mobile – during the enrollment of the aadhar card in india there are lot of the people which are not registered their mobile number with the aadhar card but Our Experts gives you to submit your udyog aadhar application without any OTPs hassle free and submit relevant documents to govt department online.

3. Right NIC Code for your Business – There are the nic code which is issued by the govt for the each type of business but when you submit the application, confuse about the right nic code so our experts are here helps to choose right NIC Code for your aadhar udyog.

4. Other necessary details – apart from the above you have to insert the investment amount, employees & incorporation date but normal business person are confuse about this because they have knowledge about their own business only. here our experts helps you to choose the right kind of details.

5. Documents Submission on Portal – if you apply for the udyog aadhar then you have to submit the basic documents for the approval to fetch your final aadhar udyog registration certificate.so here our experts helps you to preparation and submission in legal documents.

6. Changes in UAM Certificate – sometime in the udyog aadhar card there is required changes so our experts help to resubmission on the udyog aadhar application and fetch your newly certificate for the same.

7. Ministry of MSME Scheme & Subsidy – the main purpose of udyog aadhar registration is only to avail the government benefits and subsidy. but entrepreneurs are unaware about these bank loans or incentive or govt scheme so here our experts provides the basic guides through articles/videos which helps you to avail the government benefits and scheme.

Udyog Aadhaar Assistance Consultancy Package@1499/-INR

Package Includes : –

#1 Obtain Udyog Aadhaar (Udyam) Certificate by Legal Expert Assistance

#2 Free MSME Databank Registration to avail govt benefits.

#3 Govt Benefits Guidebook & Videos Step by Step to avail Loan’s & other benefits

#4 Free GST Registration & Firm Registration Voucher from MyOnlineCA

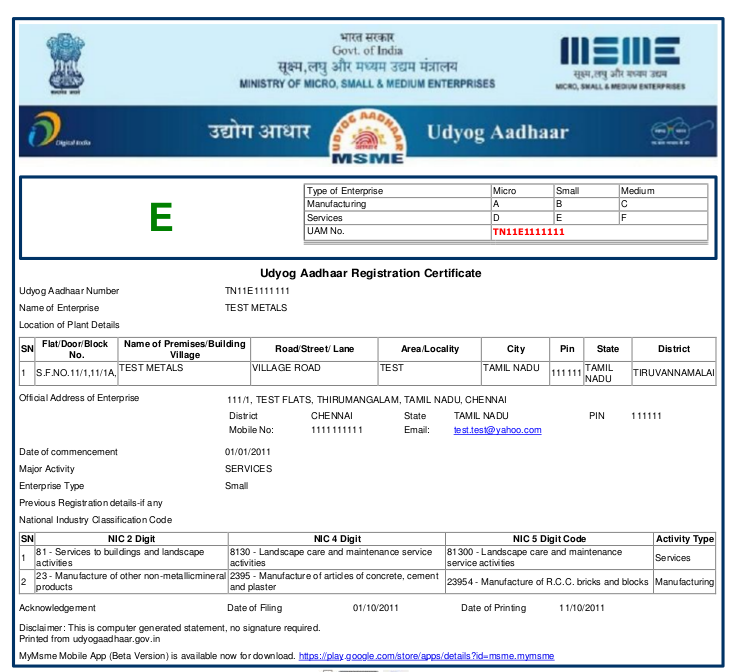

Udyog Aadhar Certificate Sample (Old)

Udyam Registration Certificate Sample (New)

Udyog Aadhar Registration Benefits

#1 Avail Govt Loan after Lockdown which is announced in May 2020

#2 Assurance against delay in Payments.

#3 Quick determination of Disputes

#4 Collateral Free credits from bank

#5 Select thought for taking an participation in international trade fair

#6 Octroi benefits

#7 Waiver of Stamp duty and Registration expenses

#8 A few Exemption under Direct Tax Laws

#9 Barcode registration appropriation

#10 Appropriation on NSIC Performance and Credit evaluations

#11 Counter Guarantee from GoI through CGSTI

#12 Decreased rate of interests from banks

#13 15% appropriation under CLCSS scheme for innovation upgradation

#14 Exclusions while applying for Government tenders

#15 Concession in Electricity Bills

#16 Repayment of expenses made for acquiring ISO accreditation

#17 1% exclusion in interest on OD

#18 Expanding eligible loan limit for ideal reasons, from the measure of Rs. 25 lakh to Rs. 50 lakh

#19 Raising the degree of certification cover from 75 % to 80 %

#20 Reservation of items for selective manufacturing by MSME/SSI