Today in this Article we discuss about High Value Transactions Income Tax SMS Notice and How to Reply E Campaign on High Value Transactions in AIS Portal. The income-tax department has started to reach out to those taxpayers who have either not filed ITR or failed to report high-value transactions accurately in their returns.

The IT department uses various techniques based on data analysis to trace income tax returns non-filers or underreporting income. Objective of the e-campaign high value transactions is to facilitate taxpayers to validate their financial transaction information against information available with the Income Tax department and promote voluntary compliance, especially for the assessee for the FY 2021-22 (AY 2022-23) & soon for AY 2023-24 so that they don’t need to get into notice & scrutiny process. The IT Department has started sending Emails & SMS to such taxpayers about e-campaign on High Value Transactions income tax on High value transactions Compliance portal.

First understand what exactly High Value transaction meaning is, the taxpayer shall report transactions in the ITR if the transactions are incurred in higher denominations and if they exceed a certain threshold. The department coordinates with different government agencies to get financial data of taxpayers devolved in high-value transactions but not reported while ITR filing.

What are the Reasons for High Value Transactions?

These are some transactions which might attract notices:

- Cash Deposit in Savings Account

- Cash deposits in the FD account

- Immovable Property -Purchase or Sale (House, Land, Apartment etc.)

- Term Deposits

- Purchase of Foreign Currency

- Purchase and sale of Shares/Mutual Funds/Bonds /Debentures

High Value transactions Income Tax SMS Notice

Who receives email/SMS of e-campaign from IT Department ?

Under e-campaign, the IT department sends high value transactions income tax sms 2022 or high value transactions income tax email to identified taxpayers for verifying their financial transactions related to information received by the IT department from different sources like TDS, TCS, and SFT etc. The IT department can collect information related to GST, imports/exports, and transactions in securities, derivatives, commodities and MF (mutual funds) through different 3rd parties.

What is High Value Transactions Income Tax SMS Notice?

An individual may receive high value transactions income tax notice via email/SMS from e-campaign when:

- No Income Tax Return Filling: Whether you did not filling the ITR or ITR was filed incorrectly, you must provide feedback upon receiving such notice.

- There are ITR discrepancies: Discrepancies do not always indicate that information has been hidden. Instead, it could be due to the errors in Annual Information Statement. You must report these errors to the IT department by ‘Providing feedback on AIS’.

How to Reply on Notice of High Value Transactions Online?

If you have received an email/SMS for high-value transactions or non-filing of returns, you can respond high value transactions notice reply to the income tax department through these described steps:

Step 1: Sign in to your income tax e-filing account.

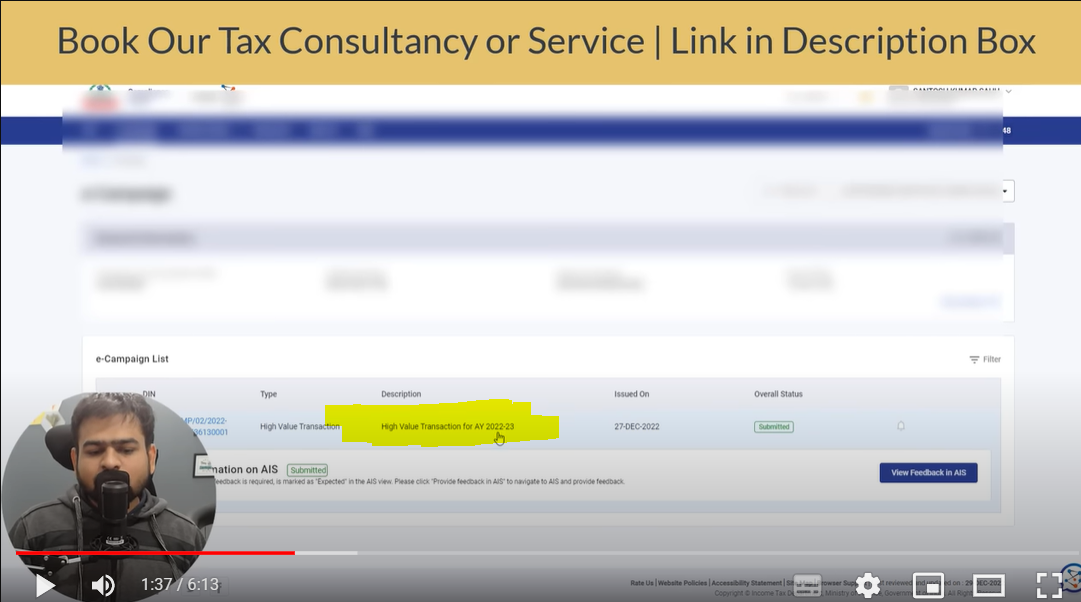

Step 2: In the home page, go to ‘Pending Actions then go to ‘Compliance Portal’ then go to ‘e-Campaign’ (AY 2021-22 onwards)’.

Step 3: Select the relevant e-campaign. After redirecting e-campaign view will be displayed. Select the relevant e-campaign > click on ‘provide feedback in AIS’. If you don’t have active e-campaigns, you will receive the message – “No Compliance Record has been generated for you”.

Step 4: Select the information category ‘e’ would be used for information category for which you have received the communication.

Step 5: Submit Response From Below options, select the most appropriate response:

- Information is correct

- Information is not fully correct

- Income is not taxable

- Information relates to other PAN/year

- Information is duplicate or included in other displayed information

- Information is denied

Under e-campaign below are the categories where the response is expected from the taxpayer:

- Preliminary Response

- Feedback on Information on AIS

Preliminary Response

Under the section named ‘Preliminary Response’, the taxpayer is expected to respond to relevant questions. The queries under the Preliminary Response section are based on campaign type (non-filing of ITR/certain high-value transactions done by the taxpayer).

Step 1: Click on the ‘Provide Response’ button on ‘Preliminary Response’ section.

Step 2: After entering next page respond by selecting the relevant drop-down.

Step 3: Provide additional details as asked by the income tax department.

If ITR has been filed:

Acknowledgement Number – Enter the Acknowledgement Number generated for ITR filed for the relevant AY.

- Date – Select Date of ITR filing

- Mode – Select Mode of ITR (i.e., e-Filed return | Paper filed return)

- Circle/ Ward & City – Enter City or circle or ward of the taxpayer

- Remarks – Enter Remarks for ITR filing (Optional)

If ITR has not been filed

Reason- Select the Reason for not-filing of ITR

Remarks- Enter Remarks for not filing the return

Step 4: After filling all the relevant information the next step is to submit the response.

If you don’t have active e-campaigns then you will get the message – No Compliance Record has been generated for you.

Submit Feedback on Information in AIS

Where there is no feedback has been provided then you need to provide feedback on the information under the e-campaign. You have to provide feedback on the L1 information marked as ‘Expected’. To know more about how to give feedback, you may click on the link: Submit feedback on information in AIS.

How MyOnlineCA Helps you if you Got High Value Transactions SMS Notice –

MyOnlineCA is leader in Tax Filing From Last Many years and one of the Biggest Youtube Channel in India in Tax Niche. So if you want to Consult with our Tax Expert about your Case and need Expert Advise & Resolved the Income Tax SMS Notice then you can Contact us Here for Consultation.