How to File Nil GST Return : GSTR 1 and GSTR 3B in Seconds

In this Article At Myonlineca, We will examine about How to file nil GST return and what is the procedure of gst nil return filling. This article will empower you to grasp whether a dealer with ZERO outward supplies is required to File nil return in Gst.

Enter your details below and get started right away to file Nil GST Return

Does a merchant or a seller with zero sales required to file Gst Return?

A shipper or a dealer needs to File GSTR 1 whether he has no business development in multi-month i.e. no arrangements in a month. An example of no outward supplies, a vendor needs to File GSTR 1. As well as You need to fill GSTR-2 and GSTR- 3 Respectively. Right Now GSTR-2 & GSTR-3 is not required to file but you have to must file the NIL GSTR-1 & GSTR3B for the same.

How To File Nil GST Return?

Before talking about the NIL GST Return we have to know which type of the Returns you have to filed under the GST Law –

Nil GSTR-1 Return –

GSTR-1 is basically detailed return where you have to upload each invoice with the amount & taxes for the same. so you can say each supplier or customer whether its B2B or B2C, all detailed mentioned in this GST with their GSTIN Number. so if you have no Supplier or Customer then you have to fill NIL GSTR-1 Return.

But Remember if you opt for the Quarterly GST Return Filing then its a Good for you because you need to file only Quarterly basis GSTR-1 NIL Return for the same.

Nil GSTR3B Return –

GSTR3B is summary of the return where you have to show your input tax & out-tax for the same. Here you need to mention only the total Sales amount & their taxes and total purchase amount with the input tax credit. Difference between these, you have to pay the taxes to the government.

GSTR3B is Monthly Return even if you choose Quarterly basis Return under GST Law because in each month you have to Pay GST taxes for the same.

Now Let’s Learn Step by Step to Filing NIL GST Return in India.

How to File GSTR-1 Nil Return : Step by Step

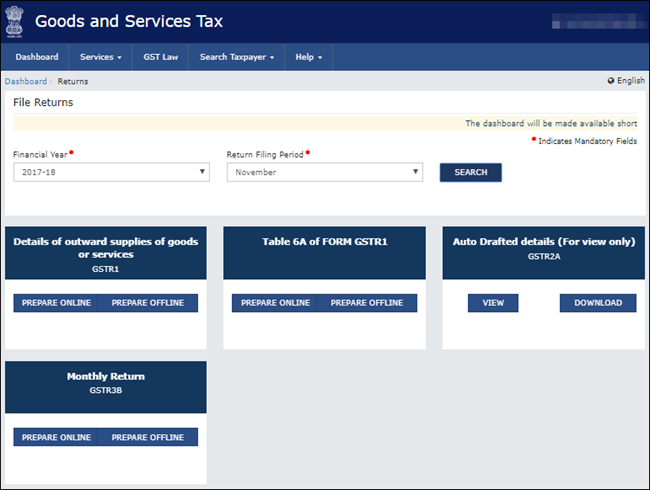

Step 1 : Login on GST Portal, utilizing this link – https://services.gst.gov.in/administrations/login . Go to Services, In the drop down select Returns Dashboard and Select month and year of scraping starting from the drop.

Step 2 : After That Click on Prepare Online under GSTR 1 tile and Enter subtle elements of Aggregate Turnover for Financial Year 2017-2018. Under GSTR 1, tap on 7 B2C (Others) tile and Click on ‘Include Details’.

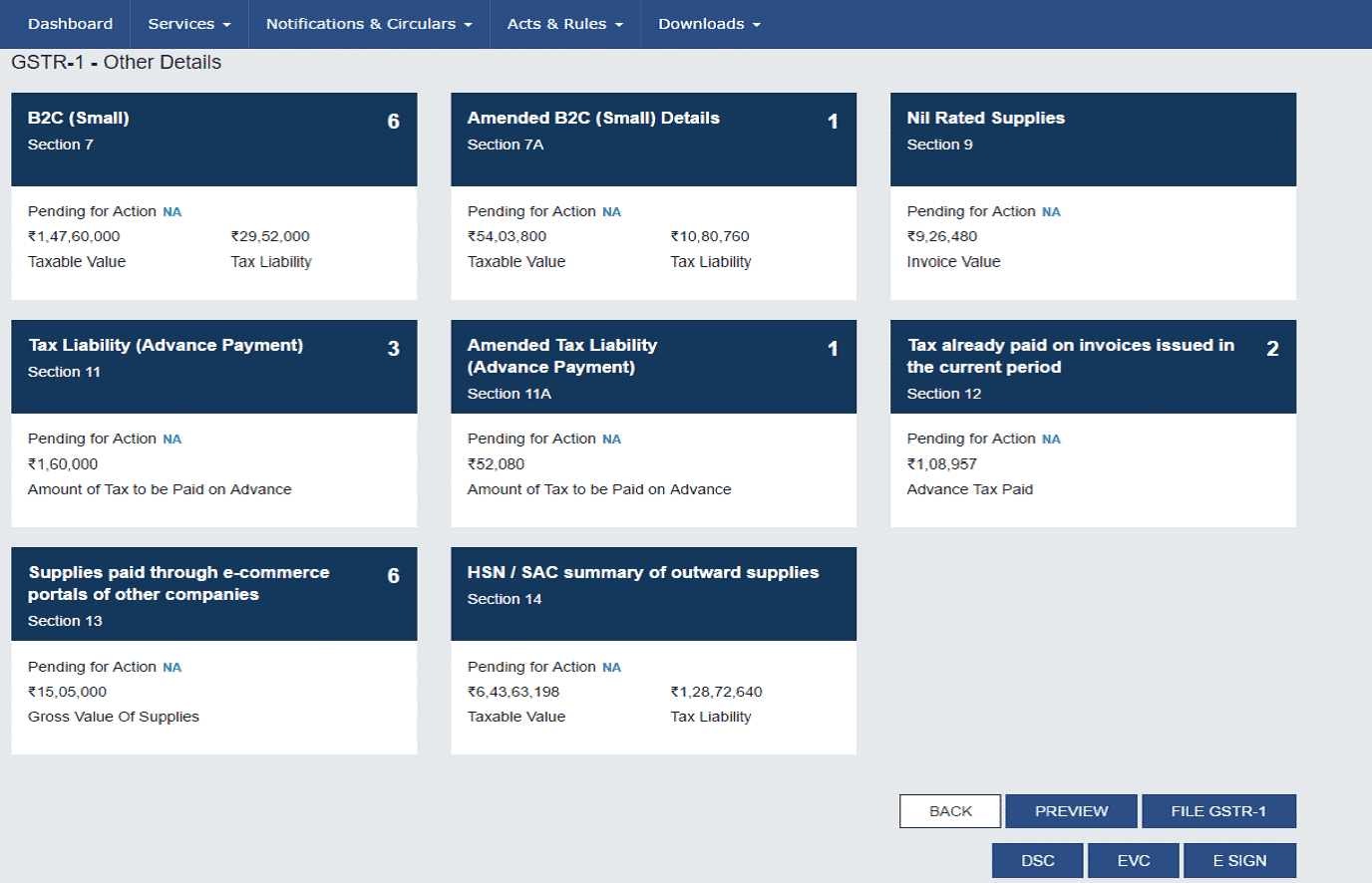

Step 3 : After That Choose POS starting from the drop and enter 0.00 in different fields and Click on Save. Once saved you can see the points of interest entered by you in a table, Click on Back and Click on Generate GSTR 1 Summary and Select the checkbox and tap on Preview

Step 4 : Tap on Submit. You can File your nil return in gst by either utilizing DSC or utilizing EVC. In view of the decision tap on File GSTR 1 with DSC or File GSTR 1 with EVC and record your Nil GSTR 1 and Once the arrival has documented an Acknowledgment will be shown expressing that the GST nil return has been recorded.

How to File GSTR-3B Nil Return?

Step 1 : Click on Prepare online in the segment titled Monthly Return GSTR3B and If all fields are nil in the GSTR3B return outline, tap on save. You can save the GSTR3B restores numerous circumstances amid the planning time to spare your advance.

Step 2 : Once the GSTR3B return is arranged and saved, click on Preview and Submit GSTR-3B. Once the GSTR3B return is presented, a window will request last affirmation. Tap on affirm and submit to document the GSTR3B return. Once the catch is clicked, the citizen won’t have the capacity to change any of the data submitted.

Step 3 : Once the GSTR3B return is submitted, tap on the Agree checkbox and carefully sign the GSTR3B come back to finish the nil GST return filling.

Conclusion on NIL GST Return Filing

I Hope you like this Article about File NIL GST Returns: Quick Guide, I Hope You will clearly understand How To file Nil Gst Return. If you are still confused you can check out our website to know more about How to File Gstr-1 Nil Return and to File GST Nil Return.

Contact Us for Nil GST Return Filling

Email : sales01@myonlineca.org

Phone : 9599715367

Direct WhatsApp Us : Click Here